Category: Blog

The Value of News

A lot has been written lately in the wake of the Thomson-Reuters deal and Rupert Murdoch’s proposal to acquire Dow Jones about the value of financial news. It is said this is the only category of news that people are prepared to pay for and that therefore these companies merit a premium.

Well far be it from me to argue about full valuations for these assets; however I do strongly believe in the value of all serious news. What makes financial news valuable when provided by a trusted source is that millions are invested or traded on the basis of this content. News is a price discovery mechanism in many non-exchange traded markets and the insight provided by great journalists helps to generate investment out performance.

General and political news can also be very valuable but many societies seem to prefer fluff and gossip about celebrities over hard news. This is perhaps a comment upon how secure and comfortable life is in many developed nations. General and political news matters most when there is a clear and present danger. In Nazi Germany in 1938 accurate news about the risks of remaining in Germany would have been very valuable to many groups that had begun to be persecuted.

Similarly news about advances in science and healthcare can be vitally important to those suffering from serious illness. Again when confronted with life and death challenges we have little interest in being entertained or to have our news presented by pretty people straight out of make-up.

Finally there is another reason we should all care about the quality of news — the key role that a free press plays in helping to educate the electorate in modern democracies. Tabloid news may not present an immediate danger in developed nations but in the long-run an informed and educated electorate is the only way to ensure the proper functioning of democratic government.

Thomson-Reuters

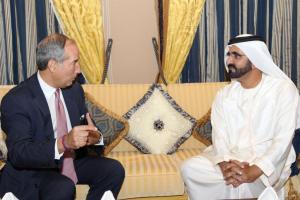

I hope you will all excuse my silence over the past few weeks as I was busy reaching our historic agreement with Thomson Corp. and at least in my little world nothing else seemed as important to comment upon.

Now that the basic information is out I just want to say how excited I am about the combination of Reuters and Thomson. I believe it will be a great pairing for our customers our shareholders and our employees. Much still lies ahead of us to realize the dream but I can already say how proud and honored I am to have been asked to lead this new company – the media company for the 21st century.

Is it Brazil’s Time?

For generations Brazil has been known as the "country of the future" quickly followed by the less complimentary view that "it would always be the country of the future." More recently Brazil has been included in the high potential "BRIC" group of emerging markets. My trip last week to Brazil suggest that the long wait may finally be over.

The Brazilian economy is experiencing a mini-boom as it has done many times before but this one is underpinned by serious fundamental factors. Growth is strong inflation is in check currency reserves are up the Reais has strengthened and is poised to move below two to the US Dollar IPOs are coming fast and furious and most tellingly there is a general expectation that Brazil’s debt will be upgraded to investment grade in the near term.

Ironically this economic success is coming in the second term of President Lula of the PT (workers party) who was originally seen as another Hugo Chavez. Lula probably owes his recent re-election more to his sound economics team than to his socialist policies. In particular Henrique de Meirelles the Governor of the Central Bank has done a masterful job of promoting growth while keeping inflation Brazil’s great historical nemesis well under control.

I have been coming to Brazil for over 40 years during which time I have made over 25 trips. I have always been struck by the warmth and optimism of the people and the incredible potential of the country. Not all is rosy of course. Official corruption is still a problem crime has gotten worse prisons are run by the prisoners and perhaps worst of all for the average Brazilian the national football team is led by rich and aging prima donnas who have been playing well below their potential.

In this generally benign environment the Reuters business in Brazil has been performing very well and I could not be happier for the excellent professional team of Brazilians who run it.

Man vs. Machine

We are doing a lot of work at Reuters these days to understand and then adapt our services to the increasingly different requirements of human and machine users.

Reuters has a 155-year history of serving the information needs of human beings around the world but Reuters was also early to recognize that in the financial services industry many of the consumers of our data were in fact other machines.

The two co-existed comfortably for many years with feeds of Reuters data being routed to terminals for human display and being drawn upon by a variety of customer applications such as risk management or end-of-day portfolio pricing systems.

However since the beginning of this century the rise of algorithmic trading coupled with the explosion in derivatives and regulatory changes have created a situation in which the needs of humans and their machines are diverging. This in turn has profound user interface as well as systems architecture ramifications for Reuters and our customers.

To provide market data and other information for machine consumption the key attributes are a comprehensive yet extensible data model to represent the information being delivered; rich metadata which describes the underlying content in a way machines can in turn use that content more fully; a published API to make it easy for customers to write their applications to use the provider’s data; a published and extensible symbology set (like Reuters RICs) to allow applications to identify the data and associate it with companies markets and instruments; and finally and of increasing importance raw speed in the form of super low-latency datafeeds.

Back on the human side things have not sat still either. So instead of just a flashing screen of impossibly fast moving news and data customers need increasingly sophisticated analytics to make sense of the torrent of available information; they need intuitive design intelligent search and far better graphics to find and display the information; and they often need a reliable mechanism to slow-down the data and only pass along changes that affect valuation rather than seeing how many times an instrument can update in one second.

In short the separation of so-called "alpha" and "beta" which has been discussed for some time in financial markets has as its corollary a separation of the man and machine involved in its production. It is overly simplistic to say machines produce "beta" (the ability to replicate market risk) and only humans can achieve "alpha" (the ability to outperform the market); however the specialization and separation of tasks between humans and machines is likely to accelerate as processing power continues to increase with new multicore CPUs data mining and other analytical software improves and the performance record of passive index funds and ETFs vs. absolute return funds vs. traditional long-only funds is better understood.

Another facet of this same phenomenon can be seen on the trading floor as machines increasingly replace humans in high-velocity thin-spread markets such as spot FX cash equities and US Treasuries while expensive humans reach for higher spreads in (as yet) less transparent markets such as credit and other derivatives and structured products.

All of this is good news for Reuters as we designed our Core Plus strategy two years ago to capitalize on these trends.

Does Tom Glocer Really Blog?

This questioned was raised recently by a group who blog at

http://thenewmarketing.com/blogs/thenewmarketing/archive/2007/03/01/813.aspx

You can find my answer posted there as well. More recursive loops …

London Chamber of Commerce – International Trade Dinner: Free Trade The Environment and Social Welfare

Here’s a speech I gave last week to the London Chamber of Commerce’s Anuual Trade Dinner. In it I address the links between free trade social welfare and protecting the environment. My basic point is that we need free trade to make the pie bigger for everyone and we need social policies that protect those who lose their jobs and safeguard the environment for the next generation.

Ladies and Gentlemen first thank you for inviting me to speak to you tonight. Your group must possess a sublime sense of irony as I understand that this is your second annual Trade Dinner and you have chosen an American commoner to follow last year’s speaker Prince Andrew. I have been very impressed by the commitment shown by Andrew in promoting UK Trade. During my time leading Reuters I have tried hard not to muck-up that achievement.

Since I doubt you were drawn here tonight to hear my thoughts on the usefulness of royalty I’d like to turn to the issue of international trade and globalization.

Businessmen (me included) usually defend globalization based on the classical economic arguments first propounded by David Ricardo and Adam Smith that free trade increases the size of the pie for all of us and thus society as a whole is better off.

I strongly believe this position and we can see it working as large parts of the population are lifted out of poverty in developing nations and the consumers in developed nations benefit from greater choice and lower prices.

Much of my world view on globalization can be traced back to my experience at Reuters. And so I thought it appropriate first if you indulge me to lay out Reuters globalization credentials which stretch back over 155 years.

In many ways Reuters is built on a philosophy of globalization. Born into a period of the 19th century when technology started to shrink the world Julius Reuter was the first person to see that a business could be made in selling information that was collected from all over the world.

Information became an asset that could be collected organized and sold. And sold not just to media customers back home in London but to newspapers banks and other organizations all over the world. This in many ways marked the real beginning of the information age.

And so Reuter went about building a business whose limits were bound only by geography and physics. Unperturbed by national borders he pushed out of Europe and into Asia (much like many UK businesses have done in recent years) opening operations in India in 1866 and in China in 1871; and then across Africa and the Americas. The latest frontier: a virtual bureau that we opened last year in Second Life.

And just like today the fortunes of Julius Reuter’s original business empire were tied to massive improvements in technology and communications. Reuter always sought out the best technology of the era to transmit the most information across the greatest distance in the shortest time.

Today we use satellite and fiber optic lines that carry IP communications. But at various times in our history it has been pigeons horses rowboats telegraph underwater cables and telex.

You probably have heard the famous story of how Baron Reuter used carrier pigeons rather than horses to bridge a gap that existed in the telegraph system between Aachen and Brussels in the 1850s.

This was truly a technological breakthrough at the time and Reuter did not just invent airmail he also pioneered the modern concept of communications redundancy that underlies the internet – by sending two pigeons with the identical packet…. By the way low-latency transmission at the time meant the pigeon didn’t stop to eat seeds on the way.

So Baron Reuter built a web around the world. And it was that international strategy harnessing new technology that delivered not just business success – but started to sow the seeds of the company’s reputation for providing trusted accurate and highly valued information be it stock market prices or breaking news. A heritage as important in 2007 as it has ever been.

Reuters today with our 2400 journalists and financial clients in every major market from New York to Nanjing is built upon Julius Reuter’s vision for an inter-connected world. Our information powers trading and decision making from large banks to hedge funds to newsrooms to governments. Our news moves markets. So you can see why at Reuters we care about globalization.

Therefore when I like you read the newspapers about the Doha trade round and more broadly about globalization I pay attention. As the CEO of a company with 17000 staff around the world I know why it is important. I also recognize that the debate is far from being resolved.

I’ve just got back from Davos where globalization was again on the agenda just like is has been for many years. The fact that people want to debate globalization at events like the World Economic Forum suggests that a consensus on whether globalization and free trade is a good thing has not yet been reached.

But here’s the crunch. Debate on this topic is too polarized too politicized. Reasoned argument often doesn’t figure. If we are going to stand any chance of making Doha a success we need to lift the debate on globalization beyond political slogans.

I care not least because I believe strongly in open free global markets but because as a father I want to help shape a future world where opportunity is not determined by the nation in which you are born.

Free trade creates economic opportunities and economic opportunities can transform all nations and reach down to touch individuals. Globalization matters if humankind is to move forward.

It’s not a case of the same wealth being shifted from one location to another as low cost countries vie for investment. But of new wealth creation – a bigger pie. A point that is all too often overlooked.

So what are the core issues? What stands in our way?

It’s at this point in speeches that you’d anticipate the line ‘put simply’. But the problem with this issue is that you can’t put it simply – you can’t sum up the obstacles in a soundbite. And in many ways that is the problem.

Globalization is an economically winning policy in the long-term but in the short-term the losers are readily identifiable and the winners are less obvious.

This complexity has led to the issue being hijacked by special interest lobbies who have sought to raise the draw bridges of protectionism – be it protecting the steel producers of America or the French blocking foreign ownership of “national champions” like yoghurt makers.

The political system makes it difficult for an elected official to make an impartial economic case about the creation of theoretical future jobs when real existing ones may be at risk.

In the long-term the effect is a negative one. No one benefits not least the national companies whose inefficiencies are masked by protective barriers. The flow of trade is interrupted. Trade sanctions begat other trade sanctions – whether it’s steel textiles or bananas.

So what do we do? Other than perhaps elect economists to high political office.

The answer like the question isn’t simple. We need to get better at explaining why free trade matters to everyone. But you shouldn’t need a Nobel in economics to see the invisible hand at work.

Before we make any progress I’d argue that one of the big political taboos we need to debate is job migration. For me too much of the globalization debate has been focused on the transfer of jobs from high wage to low wage economies.

This is important and we mustn’t forget the human cost of globalization – but this effect is declining every year as natural market forces bid up wages and the costs of doing business in places like India and China.

But also let’s not also overstate the problem of job migration. The data show that the transfer of jobs from industrialized to industrializing countries is not the uncontrolled torrent that we are led to believe.

A survey by the US Bureau of Labour found that of the 884000 American job losses in 2005 12 030 went overseas. In the UK between April 2003 and July 2006 390000 were lost – 19000 went abroad.

Of course every job lost has a painful impact – on real human beings – not just economic statistics. But the answer lies not in halting global trade but in helping the individuals and the families that are affected.

The debate has tended to focus on manufacturing jobs. However as economic commentators have pointed out manufacturing is a relatively small proportion of overall trade. And now many of the industrialized nations are starting to reposition themselves as knowledge economies attracting investment creating new kind of jobs.

Specialists in innovation design high-tech engineering financing advertising – what the Chancellor has described as the “creative industries”.

And when you look abroad my experience shows that of those jobs that we at Reuters create we build a new generation of educated global citizens who will be establishing their own wealth creating enterprises in the future.

One example is the 100 journalists that we have trained in our bureau in Bangalore – journalists that make it possible for Reuters to increase our coverage of US company news. Not jobs outsourced but Reuters employees part of the culture part of the company.

For every job we at Reuters create in our new Asian centers we receive a huge number of resumes from very talented applicants. Countries like India and China which used to send their best students abroad are now graduating hundreds of thousands of new workers each year with advanced degrees from good schools. This young workforce is highly motivated and focussed on performance and career advancement.

So there can be a win at both ends – new types of employment both in developed and developing nations – be it knowledge economy jobs here in the UK; or journalists in India cranking out earnings updates.

This is all very positive stuff – but even students of Smith like me recognise that globalization has a moral dimension. There is shadow as well as light. Although free trade leads to an increase in the wealth of nations it is often unevenly distributed certainly in the short-term.

The problem for the Ford or GM autoworker who loses his job in Detroit is that it is relatively unlikely he can simply move into a job in the new knowledge economy such as learning to be a Linux programmer.

Thus the problem as I see it is that the economic theory works well on a macro country level but not on an individual family level.

So what should we do?

I do not believe the answer lies in fighting globalization and trying to hang on to jobs that are going to disappear anyway. This is often the political impulse in Western nations but it is as useless as sticking a finger in the dam to hold back the flood.

Instead I’d argue the answer lies in social legislation which seeks to guarantee a decent minimum standard for all workers the chance for retraining the portability of pensions and affordable health care and education for the family.

In this way society can obtain the very real benefits of free and open markets. Investments can be made in education to create a trained agile workforce for the knowledge-based economy of the future and individual human beings who cannot easily transform themselves into knowledge workers can still lead meaningful lives.

This for me is the true role of government in modern market-based economies and the blueprint for continued prosperity in the West.

If Doha is to succeed the debate we have about economic benefits needs to be mirrored by political action that also builds a safety net for those who aren’t first generation beneficiaries.

Globalization needs to be managed carefully. We need to avoid making the world flat simply by beating it with a hammer. With growth comes responsibility.

And responsibility no longer just means for those who lose a livelihood but a responsibility for how we leave the planet to the next generation – another level of complexity to the globalization debate but one that we cannot avoid and must address.

Just because in the UK we contribute only 2% to carbon emissions we can’t assume it’s someone else’s problem. Climate change is a global problem that needs to be resolved at a global level.

What is the point in growing the world economy if climate change displaces the world’s rapidly growing population interrupts the production of crops threatens the supply of clean water? What is the point if climate change "ruins our planet"?

Last year China added 102 gigawatts of new energy – twice the total capacity of California. I have some sympathy when the Chinese say ‘hang on you’ve had your turn now it’s our go’. But we can’t go on like this. We need somehow to manage economic growth and a sustainable future. We must find a way of not stymieing the growth of nations like India and China but curbing emissions at the same time.

We in the industrialized nations in Europe and the United States can do that by setting an example – after all we are the biggest polluters. We can lead through innovation technological breakthroughs that deliver cleaner energy – breakthroughs that wouldn’t derail the Indian and Chinese economic locomotive but will ensure that it doesn’t run out of steam.

Combating climate change is a business opportunity and I am pleased to see that business is starting to see just that. There are profits to be made in green energy in sustainable transportation in environmentally friendly buildings. The market is waking up to this. Now political will needs to follow in its wake. Remember we’ve done it before albeit on a smaller scale when business addressed the issue of CFCs.

So in conclusion free trade open markets and economies that are flexible and able to adapt will create a bigger pie to be shared for all. Let’s focus on creating new jobs not pretending we can preserve old ones that have lost their economic raison d’etre.

At the same time let’s be realistic too – let’s nourish those for whom it is a threat help those who may be hurt and counsel those who can’t see its advantages. Most of all – let’s not turn it into a game to be played at the expense of our future prosperity. It must succeed although with a human face.

But look ultimately let’s base our policies on the most fundamental tenet of free market economics – “no exchange takes place unless both parties benefit”.

Milton Friedman’s point is a good way to end – and it’s an obvious one that we shouldn’t forget. A transaction works only if there’s something in it for both sides. In the long-term free trade makes the pie bigger – it’s our job to whet people’s appetite.

Thank you.

Quote of the Month

If you have a good quote for the Quote of the Month box just post it as a comment to this entry.

Recursive Loops – Davos 2007

In the 1980s in my C++ computer class at University I learned a powerful coding technique called recursive algorithms. The concept was simple: a given function keeps calling itself and repeating the same instructions until the result is produced.

The technique finally seems to have caught on in Davos. Everyone is blogging about what is going on in Davos to the point that no one has time to talk face-to-face anymore because they need to rush off and record the last great thought. Inviting bloggers to Davos is a good thing as it means those not attending in person can participate in the discussion and it makes the whole thing a bit more informal. But by the time I arrived on Wednesday there were already one million blog hits for "Davos 2007". At this rate we’ll all be able to stay home prevent climate change and just send our avatars to Switzerland.

I talked a bit more about blogging during an interview with the Financial Times on Thursday which you can listen to here.